Ways to Implement Salesforce

“Kyloe is the ISV solution for Institutional and Intermediary Asset Management.”

If you’re reading this, I’m going to assume you work for an asset manager. I’m also going to assume you’re evaluating Salesforce, or are at least Salesforce-curious. If you’re not in asset management, a lot of this will still be relevant. If you’ve already implemented Salesforce, a lot of this will likely be obvious.

So, how does a company implement Salesforce? And why do need to think about this anyhow?

“There are drastic differences between Institutional and Intermediary Distribution.”

You first need to understand that Salesforce doesn't just work “out-of-the-box." Salesforce is used by companies of all shapes and sizes. So Salesforce isn’t built to support the unique needs of your business, or really any business specifically. Even Salesforce’s Financial Services Cloud (FSC) requires customization. Because, while wealth management, banking, capital markets, insurance and asset management are all financial services, they are very different when it comes to client engagement, sales and servicing.

Even within Asset Management, there are drastic differences between Institutional and Intermediary Distribution. Salesforce can be set up to support both. But the engagement models differ, so the features need to be built to support the unique requirements for each channel.

FSC itself started out to address the needs of Wealth Management. Overtime additional sub-verticals such as Insurance and Banking were added on. And along the way, a lot of great cross-vertical capabilities were introduced, e.g., Omnistudio, Action Plans. But FSC was never built to address the needs of Asset Managers.

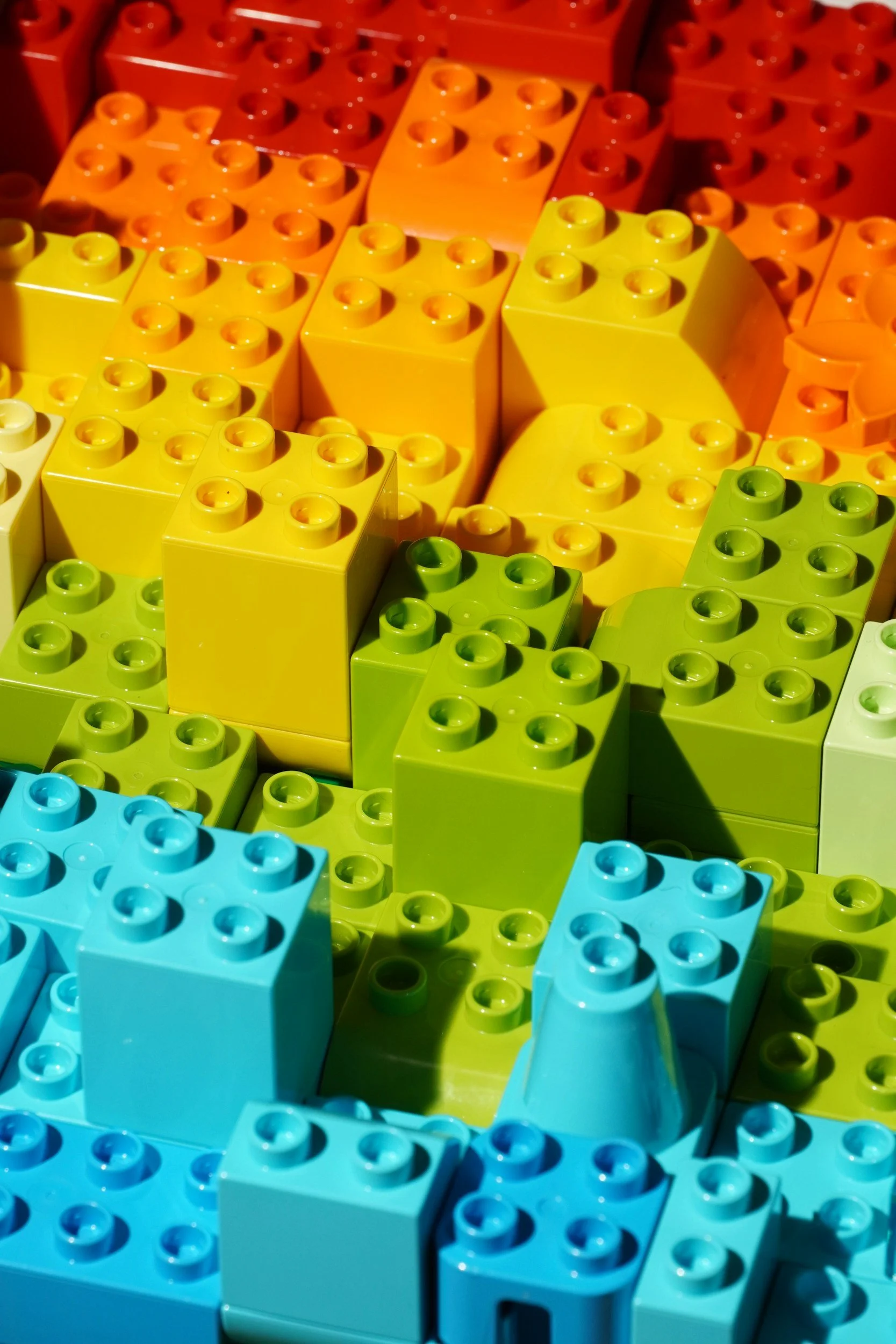

So Salesforce, and even FSC, “out-of-the-box” can be more accurately described as a box of Legos that need to be assembled. FSC includes some special shape Legos that you can use to build cool things. But you still need to put the pieces together. Beyond that, every implementation will involve some combination of data migration (getting data out of your legacy CRM and into Salesforce), data integration (hooking Salesforce up to one or more data sources and/or targets for ongoing data updates such as a portfolio accounting platform or Advisor sales data), and application integrations (connecting Salesforce with complementary technologies such as Content Management or RFP tools).

This leaves customers with a few options when implementing Salesforce:

System Integrator Partners (SIs) – by far the most common for “new-to-Salesforce” customers is tapping into the large ecosystem of Salesforce consulting partners known as SIs.

Independent Contractors – similar to SIs but often for smaller implementations, some Salesforce customers hire independent contractors, many of whom may have previously worked for an SI.

In-house Resources – Some companies, typically mid-size to larger Salesforce clients, recruit or train internal resources. Ramping up an internal team can take considerable time, so this is more commonly a strategy for existing Salesforce clients to maintain and enhance a Salesforce org that was originally implemented by outside consultants.

Independent Software Vendor Partners (ISVs) – The other side of Salesforce’s partner ecosystem, ISVs are product companies which provide pre-built Salesforce apps fine-tuned for specific industries or specific functions. Industry-specific solutions include: nCino for Banking, Veeva for Health Care, and, ahem, Kyloe for Asset Management. Examples of capability-based ISVs include Blackthorn for Event Management and Payments, and RocketDocs for RFP management.

Let’s dive a little deeper into each of these.

Salesforce SIs

The traditional approach for a Salesforce customer is to hire a consulting firm. Salesforce has a very large ecosystem of System Integrator Partners (SIs) that customize Salesforce for their clients’ needs. These SIs have different specialties. Some SIs have a vertical focus. Some have expertise in particular aspects of the Salesforce platform (e.g., Marketing Cloud or Tableau).

These SIs also range in size from Global SIs (think Accenture, Deloitte) to mid-tier (e.g., Slalom) to boutiques. Given the variety of partners to choose from, the challenge is in finding the partner that brings the optimal combination of industry knowledge, platform capabilities, delivery experience, and fits your budget. Personally, having spent 14 years building two Salesforce consultancies, and working with hundreds of clients along the way, I’d weigh cultural fit almost as high as any of those considerations when selecting a partner.

It's hard to fit all SIs into neat buckets, but below are the common flavors of SIs.

Global SIs – Global SIs have a lot of appeal. They are big, so they can scale for the largest project. They’re very likely have case studies of similar projects with similar clients. Their Salesforce practice is typically just one of many things that they do. So if your CRM implementation is part of a larger transformation program, they probably have practices which can address some of your other needs. Your firm might have multi-million-dollar contracts in place with one of the big firms, and you may already be one of their strategic accounts. And if things go sideways, they can tap into their nearly unlimited pool of resources to work through problems. Or, more cynically, no one ever got fired for choosing (enter your favorite Big 4 here).

But, all of that comes with considerations.

While Global SIs are a good option for some, they aren’t the best option for others. And for many Salesforce clients, they aren’t an option at all.

Does your firm have multi-million-dollar contracts in place? Are you a strategic client? You probably don’t want to be the largest consultancy’s smallest client.

Is your project big enough to get the “a-team”? This assumes your project is big enough to get them to bid on it in the first place.

Does your project really need to be that big anyhow? Projects have a tendency for bloat, and this is unfortunately common when your partner’s business model is based on selling billable hours.

Does your project team truly know your business? The case studies were all good. You really liked what the Head of the Salesforce practice said in the sales calls. And the Head of the Financial Services practice. And the Head of the Cloud practice. And the Head of the Analytics practice. (Did I mention bloat?) But how about the project team? Did you get the consultants that actually worked on those other projects?

So, while Global SIs are a good option for some, they aren’t the best option for others. And for many Salesforce clients, they aren’t an option at all.

Boutique SIs – “Boutiques” can encompass many things, but for this, we will consider boutiques vertical-focused Salesforce consultancies. This group is near-and-dear to me as since 2004 I cofounded two Financial Services Salesforce consulting practices (OKERE and Redkite). Run the right way, boutiques can offer a high-touch experience. With my past two companies, we always focused on making every client our most important. We made it a point to understand our clients’ business, and we always staffed project teams with resources who had experience with similar clients.

However, even with our financial services specialization, we couldn’t be experts in every sub-vertical. As I wrote earlier, the needs of a Wealth Manager are vastly different from the needs of an Asset Manager. And in the Salesforce ecosystem there are many boutique SIs who know Wealth Management (and banking, and insurance). But very few who know Asset Management. And with smaller SIs, while you can actually be a boutique’s most important client, you run a higher risk of challenges due to scale or delivery execution.

Industry-Specialists Generalists – Ok…I’ve made this term up. What I mean here, are those firms which do specialize in your industry, but provide a broad range of consulting and/or technology services. The few examples in the Asset Management industry do have Salesforce resources or practices, but are relatively new to the platform. And while they know the industry well, and maybe experts in some technologies, they may not have the depth of experience with Salesforce specifically to ensure you’re building on best practices.

Generalists SIs – I have to acknowledge these partners exists. But Asset Management is a nuanced industry. Most asset managers don’t have the time to teach consultants their business. On a future post, we will cover the things that can go wrong on a custom implementation. But needless to say, this path would be the riskiest of all SI options.

Independent Contractors

There is a healthy ecosystem of independent contractors. As Salesforce skills are in high-demand, many talented Salesforce resources realize they can make very good money working for themselves. Many contractors splinter off from SIs, clients, or even Salesforce. And if you can find a good contractor, they can be incredibly valuable.

However, in addition to the many talented Salesforce contractors, there are also those that are…less talented. Additionally, it is nearly impossible to find a contractor who has the breadth of the skills required for all the components of an implementation.

It is possible to build a team of independent contractors. But that does put the onus on you to oversee the team and steer the solution. And this is likely impractical, as you won’t have the experience in-house to architect the solution and ensure it aligns to best practices.

It may be more practical to leverage contractors to supplement a team, perhaps filling a gap in a particular skill set, such as marketing automation. Contractors can also be valuable in ongoing maintenance and support where there is typically narrower scope of responsibilities or solutioning required.

In-house Resources

This is more realistically a long-term goal for ongoing maintenance and support, rather than an initial implementation strategy. Salesforce skills are notoriously difficult to recruit for, especially when you are trying to pair that with industry expertise. It’s possible to recruit from your competitors. But it’s time consuming and expensive, and you’re going to need a team of more than one for an implementation.

If you cast your net to look outside the industry, you’re competing against every other Salesforce client in every other industry. As much as we love Asset Management, it doesn’t have the same allure as a Disney, Spotify, Nike, Amazon or even Salesforce for many candidates. Further, if you building a team of one or two, what does career growth look like? Are you in a location with a deep talent pool? Do you have a flexible location strategy?

We find up-skilling existing resources to be a successful approach for many clients. At some point, none of us knew how to configure Salesforce. But many of your employees already have a foundation of skills that will translate to Salesforce. And there is endless content for learning and a very vibrant community to tap into for help. Enabling resources who already know your organization and fit your culture is invaluable. And this can provide rewarding skill development and career advancement for employees who may currently be working on more commoditized technologies.

But again, we see this as a longer-term strategy after the initial implementation. If these resources can be identified early and participate in the implementation, even in a shadowing capacity, that can give them a great head-start. But it is impractical to build a team from scratch for the initial rollout.

Independent Software Vendors (ISVs)

This is us.

Though less common, ISVs aren’t new. Veeva blazed the trail launching in 2007, with a pre-built version of Salesforce for the Healthcare industry (NYSE: VEEV). nCino launched in 2011 with a product for commercial banking (NASDAQ: NCNO). vLocity launched in 2014 to provide solutions for various industries including Insurance, Government, Utilities and Health. Customers liked the model so much that Salesforce decided to buy vLocity for $1.33billion in 2020.

So while this model has been proven in other industries, it is new to Asset Management. Kyloe is the ISV solution for Institutional and Intermediary Asset Management.

What does that mean? Kyloe is Salesforce pre-built to meet the needs of Asset Managers. Rather than paying a consulting firm hundreds of thousands, or in many cases millions of dollars to build a Salesforce org for them, our clients subscribe to our product which delivers best-in-class functionality out-of-the-box.

We will soon have a separate post about the advantages of this model and why we’ve left our consulting pasts behind us. But in short, we can deliver richer capabilities, in less time, with less disruption, and at a lower total cost of ownership than custom implementations.

Richer capabilities, in less time, with less disruption, and at a lower total cost of ownership.

We do still have to manage migrations of data from legacy CRMs, as well as integrations with external sources and 3rd party technologies. But because we have a well-defined, and proven, solution, we can accelerate even the custom portions of an implementation. In fact, we don’t even use the term “implementation”. Rather, what was once an implementation we call onboarding. Compared to a traditional custom implementation, we are onboarding clients in half the time with our product.

There’s a lot to understand about our features, our engagement model and the benefits, and even why mature clients are moving to Kyloe. Some of those things are the common considerations of any build versus buy decision. And these will be covered in different posts. But the way that we think about it, we are delivering solutions without compromise.